Easing Call & Put OI pointing to weakening drive

India VIX fell 1.90% to 13.80 level; Highest Call OI remains at 22,500CE for 3rd week

image for illustrative purpose

The scattered positions of Open Interest (OI) on both sides of the options chain are indicating losing momentum in the market. The support level eased by 200 points to 20,500PE, while the resistance level remained at 22,500CE for a third consecutive week. The 22,500CE has highest Call OI followed by 23,000/22,200/ 22,300/ 22,400/ 22,600/ 22,350/ 22,700 strikes, while 21,700/ 21,900/ 21,850/ 22,000/ 22,400/ 22,350 strikes. Deep OTM Call strikes witnessed OI offloading.

Coming to the Put side, maximum Put OI is seen at 20,500PE followed by 21,000/ 21,500/ 21,600/ 20,800/ 21,300/ 21,400/ 20,600/ 20,400 strikes. Further, 20,800/ 21,000/ 20,700/ 21,300 strikes recorded modest addition of Put OI. OI declining is also seen at deep OTM Put strikes.

Dhirender Singh Bisht, associate vice-president (technical research) at SMC Global Securities Ltd, said: “In the Nifty options segment, the highest Call Open Interest is held at 22,000 strike followed by 21,800 strike whereas on the Put side, the highest Open Interest is at the 21,500 and 21,000 strikes.”

Despite high leverage seen in index futures, index heavyweights helped the market scale to new highs, but it couldn’t sustain. Nifty OI rose further and moved nearly 1.4 crore shares as long additions continued. Unless there’s some liquidation, the market may not pick up.

According to ICICIdirect.com, due to the sharp up move seen in the last two sessions, major writing was observed among Put strikes across the board. Fresh significant build is visible at 21,700 and 21,800 Put strikes, which are likely to act as immediate support for the Nifty. On the higher side, no major Call base is evident.

“The broader indices experienced a decline from their record highs, with Nifty witnessing a loss of over 1.2 per cent, while more 4.2 per cent drop seen in Bank Nifty on a weekly basis. During the past week, the IT and oil & gas sectors emerged as major gainers, while a correction was observed in private bank shares following result announcements from HDFC Bank, which disappointed the investors most. Kotak Bank and Indusind Bank also underwent corrections and ended the week in red. Additionally, there was some profit booking in the media and metal sectors as well,” observes Bisht.

BSE and NSE had six trading sessions last week as the market will be closed on Monday (January 22) on account of the consecration ceremony of Shri Ram mandir at Ayodhya. BSE Sensex closed the week ended January 20, 2024, at 71,423.65 points, a net fall of 1,448 points or 1.57 per cent, from the previous week’s (January 12) closing of 72,568.45 points. During the week, NSE Nifty too declined by 322.75 points or 1.47 per cent lower at 21,571.80 points from 21,894.55 points a week ago.

Bisht forecasts: “The immediate support for the Nifty lies in the range of 21,400-21,500 levels, while on the higher side 21,900-22,000 levels would act as an immediate hurdle for the markets. It is expected that the market will trade in the given range with some intraday volatility. Traders are advised to focus on sector and stock-specific moves.”

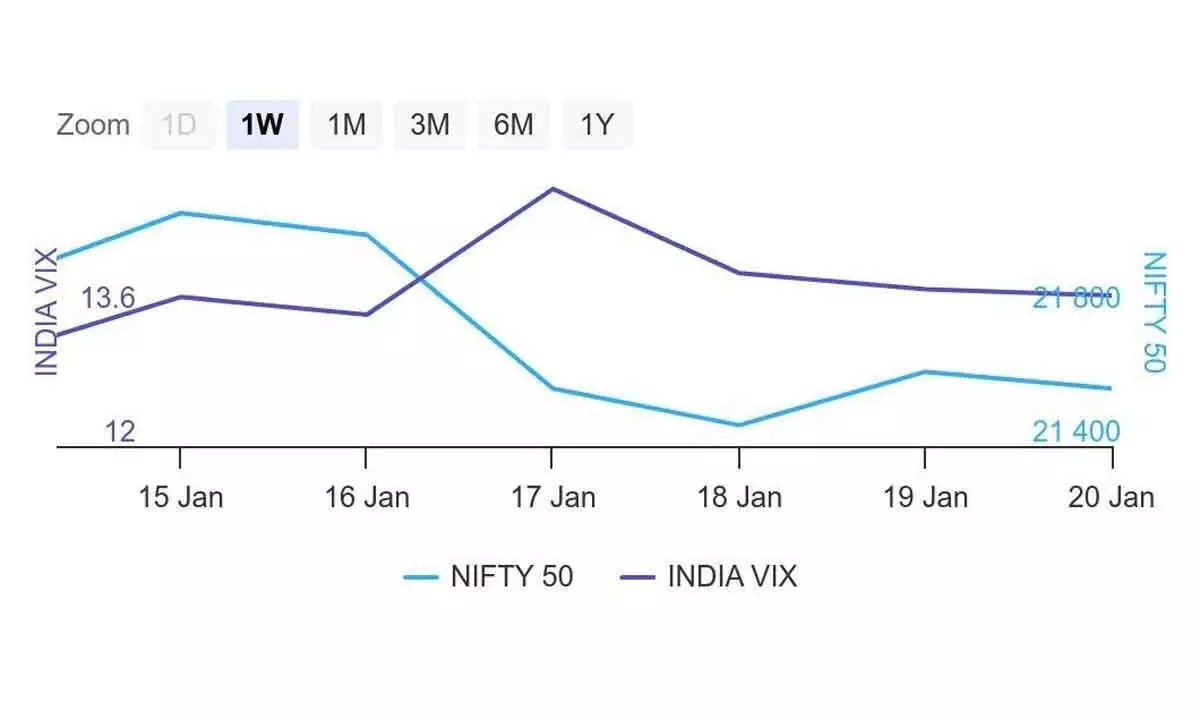

India VIX fell 1.90 per cent to 13.80 level. Earlier in the week, India VIX shot up due to the sudden move seen in the index post results from technology heavyweights. While stock-specific volatility is likely to remain high due to the ongoing results season, India VIX is likely to consolidate at 14 level in the next few sessions.

“Implied Volatility for Nifty’s Call options settled at 13.14 per cent, while Put options concluded at 14.09 per cent. The India VIX, a key indicator of market volatility, concluded the week at 14.07%. The Put-Call Ratio Open Interest (PCR OI) stood at 0.94 for the week,” said Bisht.

Bank Nifty

NSE’s banking index closed the week at 46,058.20 points, further lower by 1,651.60 points or 3.46 per cent from the previous week’s closing of 47,709.80 points. “For Bank Nifty, the highest Call Open Interest is at the 46,000 strike, while the highest Put Open Interest is at the 45,000 strike,” remarked Bisht.